Ronald Coase's study, "The Nature of the Firm," argued that

a. market exchange is less costly than hierarchical exchange

b. markets are more efficient than hierarchies

c. firms are formed to take advantage of situations in which hierarchies are more efficient than markets

d. the role of the entrepreneur is primarily to deal with central authority

e. markets tend to be less competitive over time

C

You might also like to view...

A merger between a firm extracting petroleum and a firm refining petroleum is a

A) conglomerate merger. B) diagonal merger. C) horizontal merger. D) vertical merger.

Refer to Figure 12-4. What is the amount of its total fixed cost?

A) $1,080 B) $1,440 C) $2,520 D) It cannot be determined.

A radio manufacturer has two plants -- one in Taiwan and one in California. At the current allocation of total output between the two plants, the last unit of output produced in the Taiwan plant added $8 to total cost, while the last unit of output produced in the California plant added $6 to total cost. If the firm switches one unit of output from the California to the Taiwan plant, then

A. profit will decrease $2. B. profit will increase $6. C. profit will decrease $6. D. profit will increase $14.

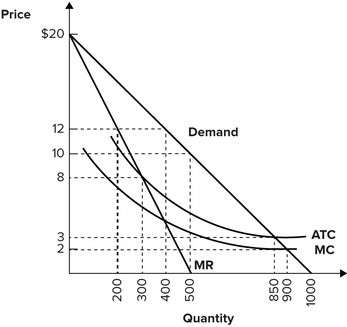

Refer to the graph shown. If this monopolist were allowed to choose the profit-maximizing level of output, it would charge a price of:

A. $2. B. $12. C. $3. D. $8.