A temporary decrease in taxes leads to

A) a small increase in current consumption.

B) a large increase in current consumption.

C) a small decrease in future consumption.

D) a large decrease in future consumption.

A

You might also like to view...

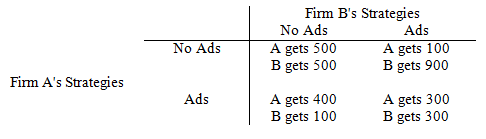

Refer to Game Matrix III. Which of the following is a property of this game?

Game Matrix III

The following questions refer to the game matrix below. Each firm has a choice of advertising, Ads, or not advertising, No ad. The profits each gets depend upon which it chooses.

a. Both firms have dominant strategies.

b. There is no pure strategy Nash equilibrium.

c. There is a Nash equilibrium and it is Pareto optimal.

d. There is a Nash equilibrium and it is not Pareto optimal.

Jobs lost to outsourcing can be partially offset by jobs gained from

A) increased output from another industry. B) greater trade imbalances. C) higher opportunity costs. D) higher production costs.

A tax cut shifts the aggregate demand curve the farthest if

a. the MPC is large and if the tax cut is permanent. b. the MPC is large and if the tax cut is temporary. c. the MPC is small and if the tax cut is permanent. d. the MPC is small and if the tax cut is temporary.

It is generally agreed that in the long run the cost of private health insurance provided by employers is:

A. at the expense of business profits. B. at the expense of real wages. C. paid by taxpayers through government. D. included as taxable income for income tax purposes.