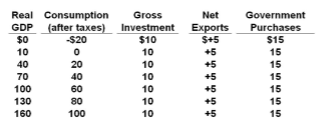

Refer to the table. A decrease in government purchases of $5 would:

A. increase real GDP by $5.

B. increase real GDP by $10.

C. decrease real GDP by $5.

D. decrease real GDP by $15.

D. decrease real GDP by $15.

You might also like to view...

In January 2009, the President submitted a bill to Congress in order to stimulate the economy and increase employment. The legislation was passed in March 2009, and the spending occurred from June 2009 to March 2011. As a result

A) the full effect of the fiscal policy change would not be felt until after March 2011 because of the effect time lag. B) the full effect of the fiscal policy change would not be felt until after March 2011 because of the recognition time lag. C) the full effect of the fiscal policy change would be felt by March 2011 because people anticipated the spending and changed their behavior accordingly. D) the full effect of the fiscal policy change would be felt when the last of the funds were spent by the government.

Suppose you own a proprietorship that is in serious financial difficulty. The assets of the company are $100,000 . but liabilities are $175,000 . You also have, however, stock in General Motors worth $200,000 . If you file bankruptcy, what amount of personal assets do you stand to lose?

a. $100,000 b. $75,000 c. $200,000 d. $275,000 e. $375,000

Which of the following does not exist when an economy is operating at full employment?

a. An unemployment rate of 5 percent or 6 percent b. Seasonal unemployment c. Structural unemployment d. Cyclical unemployment e. Frictional unemployment

Which of the following is a flow variable:

a. Income b. Money supply c. Wealth d. Debt