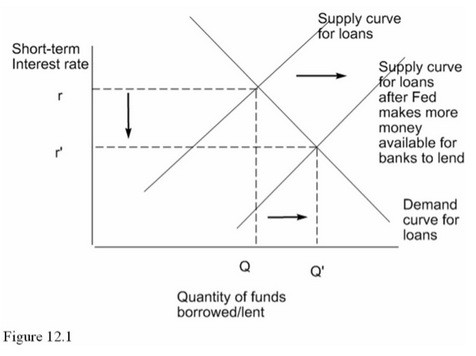

Show, using a supply-and-demand diagram, what would happen to the short-term interest rate (that is, the federal funds rate) if the Federal Reserve increases the amount of money available to banks to lend.

What will be an ideal response?

By making more money available to banks to lend, the supply curve for overnight loans shifts to the right, which in turn reduces interest rates. See Figure 12.1 as an example.

You might also like to view...

Which of the following statements is equivalent to the law of diminishing marginal returns?

A. A stitch in time saves nine. B. You can’t make an omelet without breaking eggs. C. Too many cooks spoil the broth. D. If you can’t stand the heat, get out of the kitchen.

The interest rate is:

A. only a return to borrowers. B. both a cost to savers and a return to borrowers. C. both a return to savers and a cost to borrowers. D. a cost to both savers and borrowers. E. only a cost to savers.

Willingness to pay measures

A) the maximum price that a buyer is willing to pay for a good or service. B) the amount a seller actually receives for a good minus the minimum amount the seller is willing to accept for the good. C) the maximum price a buyer is willing to pay minus the minimum price a seller is willing to accept. D) the maximum price a buyer is willing to pay for a product minus the amount the buyer actually pays for it.

The monetarists totally reject the importance of changes in the money stock as determinants of changes in real GDP, the price level, and employment

a. True b. False Indicate whether the statement is true or false