Income tax on the wealthy to finance the welfare for the poor causes income redistribution. This is an example for the trade-off

A) Which goods and services to produce.

B) How to produce.

C) Who gets the goods and services.

D) Who produces the goods and services.

C

You might also like to view...

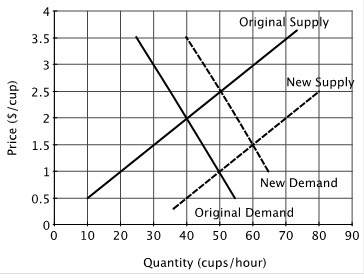

Refer to the figure below. Consider the original supply and the original demand curve. If the government imposes a price ceiling of $1.00 on a cup of coffee, then there would be:

A. a new equilibrium at a price of $1.00 per cup and a quantity of 50 cups per hour. B. a short-term excess demand for coffee, followed by an increase in the equilibrium price. C. an excess supply of coffee. D. an excess demand for coffee.

If a marginal cost pricing rule is imposed on the firm in the figure above, the consumer surplus will be

A) zero. B) $800. C) $400. D) $200.

Which of the following is an equilibrium condition in the ISLM model?

A) Labor demand = labor supply B) Desired investment = desired saving C) Government spending = taxation D) Money supply = income

Which of these four-firm concentration ratios suggests that an oligopoly exists in an industry?

a. 5 percent b. 25 percent c. 50 percent d. 95 percent