Taxes are increased by $50 billion and income decreases by $300 billion. The value of the tax multiplier is

A. -3.

B. -5.

C. -6.

D. -15.

Answer: C

You might also like to view...

Nominal interest rates tend to be higher in countries with

A) higher rates of inflation. B) lower rates of inflation. C) lower real interest rates. D) Both B and C.

The slope of the Phillips curve in the United States was smallest during which period?

A) 1985-2012 B) 1970-1984 C) 1947-1969 D) 1776-1800

Poor economies may have difficulty growing because

a. their production possibilities curves slope upward instead of downward b. they cannot cut back on their production of consumption goods to increase their production of capital goods c. they have a solid consumption base already in place d. their resource bases are fully developed e. the law of increasing costs makes it hard to produce more goods

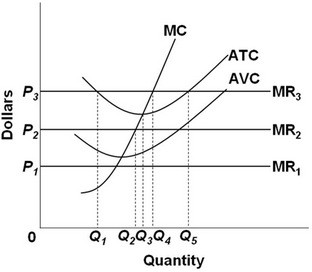

Refer to the above diagram. All data are for the short run. The firm represented in this diagram is selling under conditions of:

Refer to the above diagram. All data are for the short run. The firm represented in this diagram is selling under conditions of:

A. pure competition. B. pure monopoly. C. oligopoly. D. monopolistic competition.