Government policies regarding taxes and expenditures are called

A. fiscal policy.

B. income policies.

C. monetary policy.

D. supply-side policy.

Answer: A

You might also like to view...

Total utility increases if one more unit of a product is purchased and marginal utility is negative.

Answer the following statement true (T) or false (F)

John wants to buy a new lawn mower. He can either buy it in the US and pay $500 or buy it in Mexico and pay 6188 Mexican Pesos. At the exchange rate of 1 Mexican Peso=0.771US$, ignoring any other costs, he would

a. Prefer buying in the US b. Prefer buying in Mexico c. Be indifferent about where he buys his television d. None of the above

A popular video program used to teach economics to primary school children defines opportunity cost as "what you give up to get something." In light of your understanding of opportunity cost, how would you modify this definition?

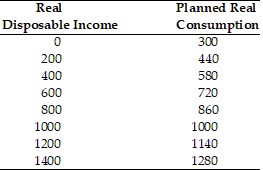

Refer to the above table. The table gives the combinations of real disposable income and real consumption for a college student for a year. What is the value of the marginal propensity to consume?

Refer to the above table. The table gives the combinations of real disposable income and real consumption for a college student for a year. What is the value of the marginal propensity to consume?

A. 0.3 B. 0 C. 1 D. 0.7