A negative externality exists and government wants to impose a per-unit tax in order to bring about the socially optimal output. To accomplish its objective, government must set the tax equal to marginal

A. private cost.

B. social benefit.

C. external cost.

D. social cost.

E. private benefit.

Answer: C

You might also like to view...

Because pollution reduces economic welfare, on this count real GDP as measured

A) decreases as pollution increases. B) increases to take into account the expenditures that will be made in the future to clean up the pollution. C) overstates economic welfare. D) understates economic welfare.

University researchers create a positive externality because what they discover in their research labs can easily be learned by others who haven't contributed to the research costs. Suppose that the federal government gives grants to these researchers equal to the their per-unit production externality. What is the relationship between the equilibrium quantity of university research and the

socially optimal quantity of university research produced? a. The equilibrium quantity is greater than the socially optimal quantity. b. They are equal. c. The equilibrium quantity is less than the socially optimal quantity. d. There is not enough information to answer the question.

As firms control more of an industry, it becomes more likely they can raise prices and harm consumers.

a. true b. false

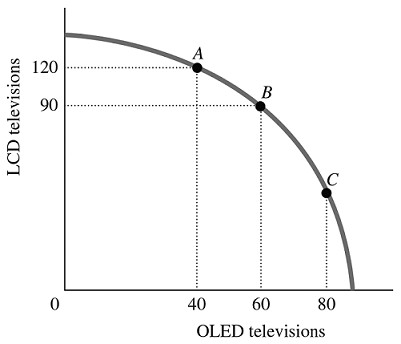

Refer to the information provided in Figure 2.5 below to answer the question(s) that follow. Figure 2.5Refer to Figure 2.5. For this economy to move from Point A to Point B, ________ additional OLED TVs could be produced when the production of LCD TVs is reduced by 30.

Figure 2.5Refer to Figure 2.5. For this economy to move from Point A to Point B, ________ additional OLED TVs could be produced when the production of LCD TVs is reduced by 30.

A. exactly 20 B. more than 20 C. fewer than 20 D. exactly 90