A decrease in taxes on the current generation would have no effect on consumption or nationalsaving if

A. individuals increase their consumption by less than the tax cut.

B. consumers are not forward looking concerning their future tax burden.

C. consumers bequeath all of the tax cut to the next generation.

D. individuals face borrowing constraints.

Answer: C

You might also like to view...

Discuss some of the factors that lead infant manufactured goods industries to become more efficient over time, and some of the factors that might lead them to fail to do so

What will be an ideal response?

If only one firm in an industry could take advantage of a reduced wage and all other firms continue paying the old wage, how would one best describe the one firm's reaction to this reduced wage assuming labor is the only variable input? The

marginal revenue product of labor curve A) would remain unchanged, and the firm would hire more labor at the lower wage. B) shifts to the left, and the firm hires more labor at the lower wage on the new curve. C) shifts to the right, and the firm hires more labor at the lower wage on the new curve. D) shifts to the left, and the firm hires less labor at the lower wage on the new curve. E) shifts to the right, and the firm hires less labor at the lower wage on the new curve.

Hold-up can only occur if

a. Costs are fixed b. Costs are sunk c. Costs are avoidable d. Costs are incurred

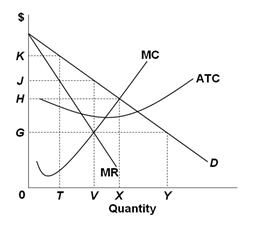

Refer to the graph below for a profit-maximizing monopolist. The firm will produce the quantity:

A. 0V

B. 0Y

C. 0T

D. 0X