How does the price system cope with depletable resources?

What will be an ideal response?

The rule is that under perfect competition, when the cost of transportation and extraction are negligible, resource prices should rise at the rate of interest. The reasoning is that the owner of a stock of the resource has the choice to sell the stock and invest the proceeds at the market rate of interest or hold the stock in anticipation of a future price increase. The owner will be indifferent between these when the rate of price increase in the resource equals the interest rate on monetary investments. If the rate of price increase exceeds the interest rate, the owner will hold the stock (as will all other owners), which will raise the price at present, but will create a large supply for future sale and depress the future price. This could create an arbitrage opportunity, which would force the rate of price increase to fall. Conversely, if the rate of price increase is less than the interest rate, the owner will sell the stock and invest the proceeds. The price of the resource will fall at present, but the future price will rise to a higher level. Again, an arbitrage opportunity will force the rate of price increase to rise.

You might also like to view...

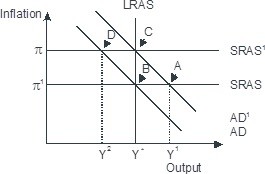

Based on the figure below. Starting from long-run equilibrium at point C, a tax increase that decreases aggregate demand from AD1 to AD will lead to a short-run equilibrium at point ________ and eventually to a long-run equilibrium at point ________, if left to self-correcting tendencies.

A. D; C B. D; B C. A; B D. B; C

Use the information in the following table to answer the next question.(1) Interest Rate(2) Investment (billions of dollars)(3) Investment (billions of dollars)4%$100$8059070680607705086040In the table, investment is in billions. Suppose the Fed reduces the interest rate from 6% to 5% at a time when the investment demand declines from that shown by column (2) to that shown by column (3). As a result of these two occurrences, investment will ________.

A. increase by $20 billion B. increase by $10 billion C. decrease by $20 billion D. decrease by $10 billion

Explain the difference between the marginal rate of substitution and the marginal rate of transformation

What will be an ideal response?

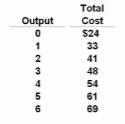

Refer to the data. The average total cost of producing 3 units of output is:

A. $14.

B. $12.

C. $13.50.

D. $16.