Economists argue that the corporate income tax is an example of a tax with a high deadweight loss because

A) it encourages corporations to seek ways to evade taxes.

B) taxing a corporation's income amounts to double taxing the earnings on individual shareholders' investments in corporations.

C) some of the burden of the tax is passed on to consumers in the form of higher prices.

D) it discourages corporations from undertaking capital investments to enhance market competitiveness.

B

You might also like to view...

The marginal propensity to consume is the slope of the consumption function

Indicate whether the statement is true or false

Analysis of macro policy and theory has resulted in of the following views?

A) There should be no constraints imposed on fiscal or monetary policy. B) A constitutional amendment is the most appropriate method to constrain fiscal policy. C) The heads of the central bank should be chosen by popular elections. D) all of the above E) none of the above

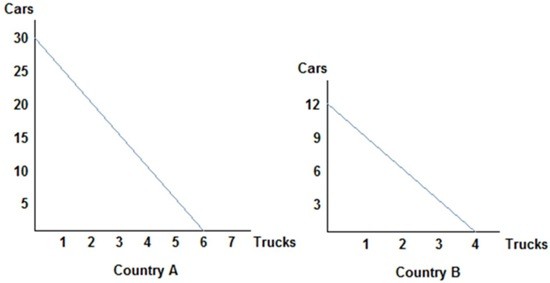

Refer to the figure shown, which represents the production possibilities frontiers for Countries A and B. After comparing each country's production possibilities curve, it is clear that:

Refer to the figure shown, which represents the production possibilities frontiers for Countries A and B. After comparing each country's production possibilities curve, it is clear that:

A. Country B will lose by trading with Country A. B. Country A should specialize in trucks and Country B should specialize in cars, and both will benefit from trade. C. Country A should specialize in cars and Country B should specialize in trucks, and both could benefit from trade. D. Country A will not benefit from trade.

Refer to Scenario 7.4 below to answer the question(s) that follow.SCENARIO 7.4: You own and are the only employee of a company that sells custom embroidered pet sweaters. Last year your total revenue was $120,000. Your costs for equipment, rent, and supplies were $30,000. To start this business you invested an amount of your own capital that could pay you a $50,000 a year return.Refer to Scenario 7.4. Your economic profit last year was

A. -$20,000. B. $40,000. C. $70,000. D. $90,000.