Empirical evidence indicates that imposing taxes on polluting emissions by firms

A. has no effect on the amount of pollution emitted.

B. does not give the government leeway to regulate more dangerous emissions differently than less dangerous emissions.

C. does reduce the amount of pollution emitted.

D. discourages firms from investing in new methods of pollution abatement.

Answer: C

You might also like to view...

Why must the current account and the financial account sum to zero? (Assume the capital account is zero.)

What will be an ideal response?

An economist from which school of thought would most likely accept the following- "The wide acceptance and practice of activist government fiscal policy."

a. Traditional classical economics b. Neoclassical economics c. Marxist economics d. New monetarist economics e. Keynesian economics

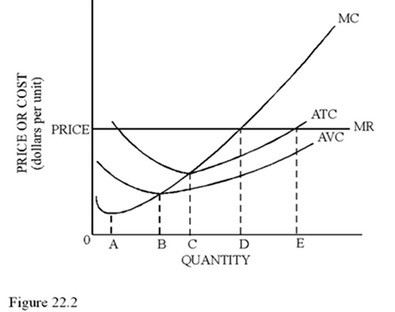

Refer to Figure 22.2 for a perfectly competitive firm. The profit-maximizing quantity of output is

Refer to Figure 22.2 for a perfectly competitive firm. The profit-maximizing quantity of output is

A. B. B. C. C. D. D. E.

Consider the production possibilities curve for a country that can produce sweaters, apples (in bushels), or a combination of the two.

A. Which point(s) on the graph is (are) efficient production possibilities? B. Which point(s) on the graph show unemployment of resources? C. What is the opportunity cost of moving from point R to point Q? D. What is the opportunity cost of moving from point T to point R?