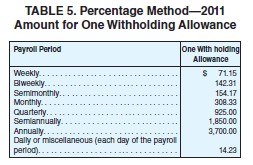

Use the percentage method of withholding to find the federal withholding tax, a 6.2% FICA rate to find the FICA tax, and 1.45% to find the Medicare tax. Then find the net pay for the employee. Assume that the employee has not earned over $110,000 so far this year.

Robert Stang has gross earnings of $523.16 weekly. He is married and has 3 withholding allowances.

Robert Stang has gross earnings of $523.16 weekly. He is married and has 3 withholding allowances.

A. $498.90

B. $467.36

C. $483.13

D. $507.39

Answer: B

Mathematics

You might also like to view...

Determine whether the given value is a solution to the given equation.k =  ; k +

; k +  = 5

= 5

A. solution B. not a solution

Mathematics

Determine whether the graph of the equation is symmetric with respect to the x-axis, the y-axis, and/or the origin.y = x + 1

A. origin B. y-axis C. x-axis D. x-axis, y-axis, origin E. none

Mathematics

Solve the equation.25x4 - 61x2 + 36 = 0

A.

B.

C.

D.

Mathematics

Factor completely using the trial and error method to factor trinomials. If unfactorable, indicate that the polynomial is prime.-36x2 - 30x + 36

A. -6(3x - 2)(2x + 3) B. prime C. -6(3x + 2)(2x - 3) D. (-18x + 12)(2x + 3)

Mathematics