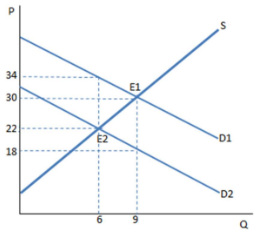

The graph shown demonstrates a tax on buyers. How many fewer units are being sold due to the imposition of a tax on this market?

A. 6

B. 9

C. 3

D. 12

C. 3

You might also like to view...

In a perfectly competitive industry, the price of good A is $2 . If a firm in this industry decides to increase its price to $2.50, it will:

a. realize an increase in profit of $0.50 per unit output. b. be able to increase the quantity sold of good A. c. be unable to sell any quantity of good A that is produced. d. lose some of its customers in the market. e. experience a decrease in profit of $0.50 per unit output.

In the Keynesian model, the most important influence on planned consumption is

a. the interest rate. b. expectations. c. disposable income. d. the price level.

The income velocity of money is the absolute number of times, on average, that

A. each one-unit increase in the price level occurs. B. each unit of real Gross Domestic Product (GDP) is produced by business firms. C. each monetary unit is spent on final goods and services. D. people purchase goods and services during a year.

Which of the following items are included in money supply M2 but not M1?

A. Federal Reserve notes B. Coins C. Savings deposits D. Checkable deposits