If the Fed wanted to expand the money supply as part of an antirecession strategy, it could

a. increase the interest rate paid on excess reserves encouraging banks to extend more loans.

b. decrease the interest rate paid on excess reserves encouraging banks to extend more loans.

c. decrease the interest rate paid on excess reserves encouraging banks to hold excess reserves rather than extend more loans.

d. increase the interest rate paid on excess reserves encouraging banks to hold excess reserves rather than extend more loans.

B

You might also like to view...

If you take out a bank loan prior to unanticipated inflation

A) your bank will gain at your expense. B) you will gain at the expense of your bank. C) it will be harder for you to repay the loan because of the inflated dollar. D) neither you nor your bank will be affected, because the loan was made prior to the inflation.

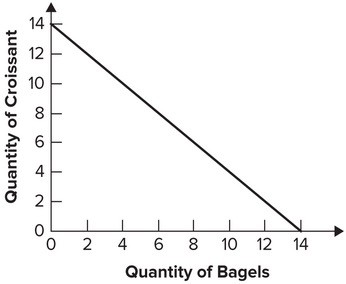

Refer to the graph shown. Which price combination is consistent with the budget line shown?

A. $2 per bagel, $2 per croissant B. $3 per bagel, $2 per croissant C. $2 per bagel, $4 per croissant D. $6 per bagel, $3 per croissant

Which of the following is not true?

A) The share of total farm receipts earned by the largest farms has been increasing during the past two decades. B) Productivity in the farm sector has increased dramatically over the past 50 years. C) The own-price elasticity is always negative. D) None of the above (that is, all statements are true).

Which of the following macroeconomic variables is procyclical and lags the business cycle?

A. Employment B. Business fixed investment C. Stock prices D. Nominal interest rates