The payroll factor in the UDITPA state income tax apportionment formula always includes executive compensation.

Answer the following statement true (T) or false (F)

False

You might also like to view...

Which of the following states that supervisors' attitudes and expectations of employees and how they treat them largely determine employees' performance?

A. The halo effect B. The self-actualization theory C. The Pygmalion effect D. The expectation theory

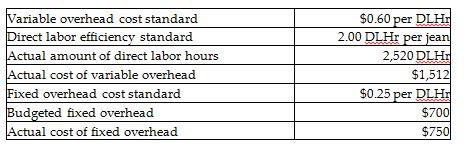

Sharp Company manufacturers jeans. In June, Sharp made 1200 pairs of jeans, but had budgeted production at 1400 pairs of jeans. The allocation base for overhead costs is direct labor hours. The following additional data is available for the month:

Calculate the following variances:

a. Variable overhead cost variance

b. Variable overhead efficiency variance

c. Total variable overhead variance

d. Fixed overhead cost variance

e. Fixed overhead volume variance

f. Total fixed overhead variance

When preparing a statement of cash flows using the indirect method, why is depreciation added back to net income within the operating activities section?

Last year Lawn Corporation reported sales of $115,000 on its income statement. During the year, accounts receivable decreased by $10,000 and accounts payable increased by $15,000. The company uses the direct method to determine the net cash provided by (used in) operating activities on the statement of cash flows. The sales revenue adjusted to a cash basis for the year would be:

A. $100,000 B. $140,000 C. $90,000 D. $125,000