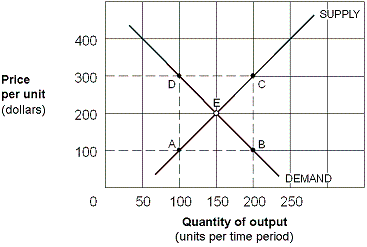

Exhibit 5-9 Supply and Demand Curves for Good X

?

As shown in Exhibit 5-9, the $200 per unit tax on Good X raises tax revenue per time period totaling:

A. $10,000.

B. $20,000.

C. $30,000.

D. $60,000.

Answer: B

You might also like to view...

Why do landlords tend to discriminate against a person's race, religion, or age more when rent controls are imposed?

A) Landlords are naturally racist and bigoted. B) Only minority groups will take an interest in apartments with controlled rents. C) Economists will encourage landlords to discriminate. D) Rent controls lower the personal costs of discriminatory behavior among landlords. E) For all of the above reasons.

If a firm's long-run average total curve shows that it can produce 5,000 DVDs at an average cost of $2.00 and 15,000 DVDs at an average cost of $1.50, this is evidence of

A) economies of scale. B) the law of supply. C) diminishing returns. D) diseconomies of scale.

Most of the TARP funds were used to

A) fund a stimulus package. B) pay for losses incurred by Fannie Mae and Freddie Mac. C) finance the operations of the Federal Reserve. D) make direct purchases of preferred stock in banks to increase their capital.

As of 2012, about how many banks were there in the United States?

A) 57 B) 2000 C) 6200 D) 14,000