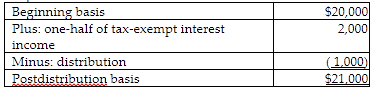

William and Irene each contributed $20,000 cash to the WI Partnership on January 1 of last year. William and Irene share profits and losses equally. Last year, the partnership reported tax-exempt interest income of $4,000. This year, each partner receives $1,000 of the tax-exempt interest income in a cash distribution. There are no partnership liabilities and no other income, loss, contributions,

or distributions during both years. William's basis in the partnership interest following these transactions is

A) $19,000.

B) $20,000.

C) $21,000.

D) $22,000.

C) $21,000.

You might also like to view...

Answer the following statements true (T) or false (F)

1. A formal group typically has no officially appointed leader, although a leader may emerge from members of the group. 2. In the workplace, informal groups can undercut the plans of formal groups. 3. Informal groups can be highly productive, even more so than formal groups. 4. Research finds that the majority of workplace learning occurs in formal groups.

Errors and omissions insurance is a type of products liability insurance that manufacturers of consumer goods purchase

Indicate whether the statement is true or false

Timothy, who lives alone, has a comprehensive general liability home insurance policy with the Great Pacific insurance company. He is planning to travel the world for a year and leave his home locked up while he is away

Which of the following should Timothy do? A) Tell the insurance company of his plans to leave the house vacant as doing this constitutes a change in the risk. B) Tell the insurance company of his plans because if he does not it will breach the fiduciary duty he owes the insurance company C) Give the insurance company of a forwarding address in case it needs to contact him D) Tell the insurance company so he can get a major reduction in his rates. E)He does not have to tell the insurance company as he still owns the property and he is free to travel.

Suppose a U.S. firm buys $200,000 worth of television tubes from a Mexican manufacturer for delivery in 60 days with payment to be made in 90 days (30 days after the goods are received). The rising U.S. deficit has caused the dollar to depreciate against the peso recently. The current exchange rate is 5.68 pesos per U.S. dollar. The 90-day forward rate is 5.45 pesos/dollar. The firm goes into the forward market today and buys enough Mexican pesos at the 90-day forward rate to completely cover its trade obligation. Assume the spot rate in 90 days is 5.30 Mexican pesos per U.S. dollar. How much in U.S. dollars did the firm save by eliminating its foreign exchange currency risk with its forward market hedge? Do not round the intermediate calculations and round the final answer to the

nearest cent. ? A. $4,542.43 B. $5,899.26 C. $5,309.33 D. $5,840.26 E. $6,725.15