According to the law of diminishing utility, _____

a. the same tax rate should be applied to every dollar

b. the rich people should have a lower tax rate as compared to poor people

c. the rich people should have a higher tax rate as compared to poor people

d. the total burden on the society from a tax will be less if proportional taxation is used

e. the poorer people should not be taxed at all

c

You might also like to view...

Assume there is a simultaneous decrease in the cost of batteries used in hybrid cars and a shift in consumer preferences toward more fuel-efficient vehicles

Based on this, we can conclude, with certainty, that in the market for hybrid cars, equilibrium: A) price will decrease. B) price will increase. C) quantity will decrease. D) quantity will increase.

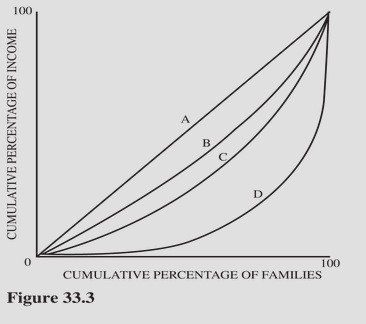

Figure 33.3 illustrate four different Lorenz curves. Assume Brazil has a larger Gini coefficient than the United States. If the income distribution for the United States is represented by curve C, which curve would must represent the income distribution for Brazil?

Figure 33.3 illustrate four different Lorenz curves. Assume Brazil has a larger Gini coefficient than the United States. If the income distribution for the United States is represented by curve C, which curve would must represent the income distribution for Brazil?

A. A. B. B. C. C. D. D.

Which of the following groups are positively affected by foreign direct investment outflows?

A. Taxpayers in the home country B. The owners of the multinationals C. The home country's government D. The home country's labor unions

According to Congressional Budget Office (CBO) projections:

A. budget deficits are expected to give way to surpluses by the year 2017. B. Social Security will become insolvent by 2017. C. expiration of tax cuts in 2015 will cause the budget deficit to rise to record highs by 2017. D. budget deficits are expected to remain large for the next several years.