McCarthy Construction is trying to bring the company-funded portion of its employee retirement fund into compliance with HB-301. The company has already deposited $500,000 in each of the last 5 years. If the company increases its deposits beginning in year 6 by 15% per year each year through year 20, how much will be in the fund immediately after the last deposit, provided the fund grows at a rate of 12% per year? Solve using (a) tabulated factors, and (b) a spreadsheet.

What will be an ideal response?

(a) Find P in year 4 for the geometric gradient,

then move all cash flows to future

P 4 = 500,000[1 – (1.15/1.12) 16 ]/(0.12 – 0.15)

= $8,773,844

F = 500,000(F/A,12%,4)(F/P,12%,16) + P 4 (F/P,12%,16)

= 500,000(4.7793)(6.1304) + 8,773,844(6.1304)

= $68,436,684

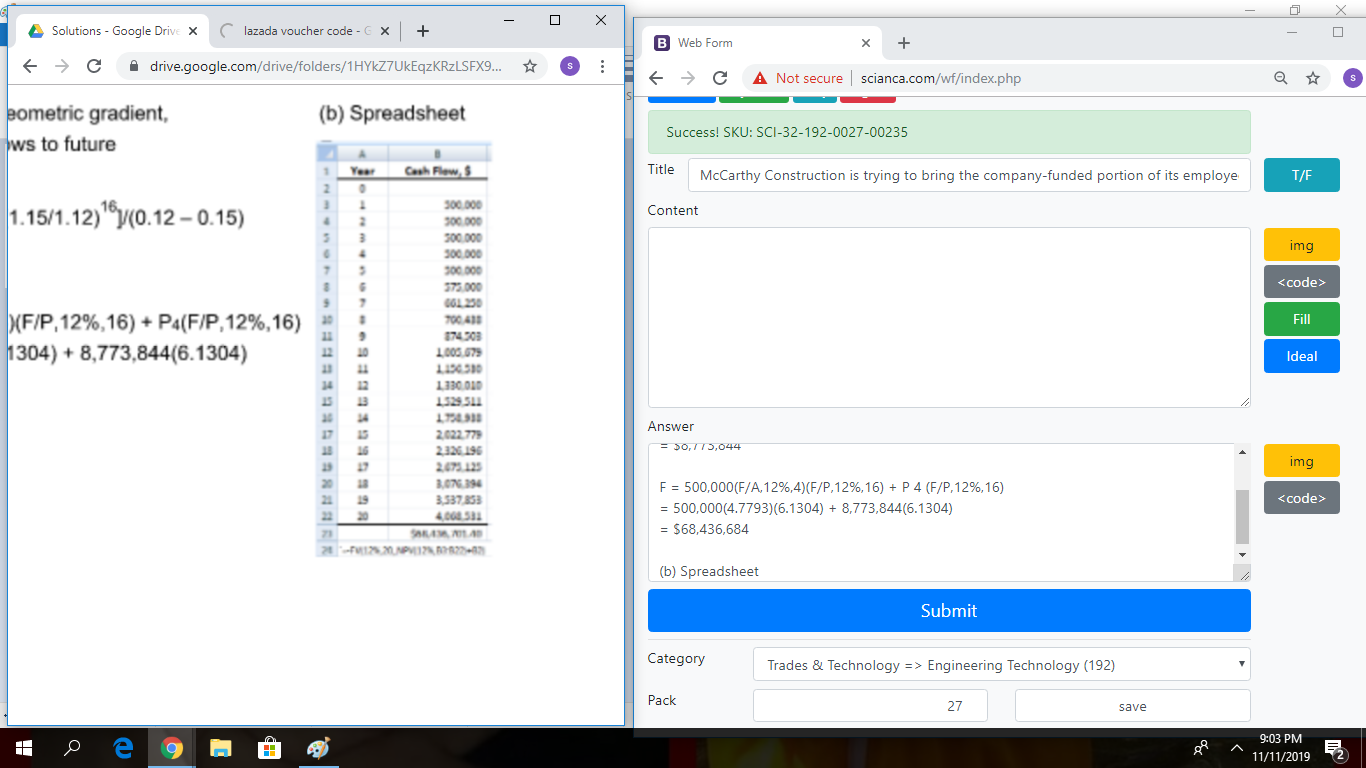

(b) Spreadsheet

You might also like to view...

____________________ trainers are one of the most common types of animal trainer, and there are many disciplines within this area

Fill in the blank(s) with correct word

The condenser ____.

A. rejects the heat from the refrigerant B. controls the refrigerant flow throughout the system C. adds superheat to the refrigerant D. All of the above.

An accumulator such as that used on hydraulic brake boosters ________

A) Provides higher force being fed back to the driver's foot B) Provides a reserve in the event of a failure C) Reduces brake pedal noise D) Works against engine vacuum

The shortest distance from the root of a fillet weld to the weld face is the _____

a. weld toe b. theoretical throat c. actual throat d. weld leg