How much deadweight loss a tax causes is primarily determined by:

A. how responsive buyers and sellers are to a price change.

B. how much tax revenue the government generates.

C. whether the tax is imposed on the buyer or seller.

D. the ability of the government to impose the tax.

A. how responsive buyers and sellers are to a price change.

You might also like to view...

Diversification is determined by adding value

Indicate whether the statement is true or false

Which of the following does not represent a market?

A.) Buyers at a garage sale B.) Paying your property taxes at the courthouse C.) Selling peaches at a state fair D.) A young couple shopping for a new car

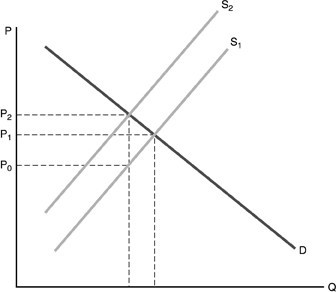

Refer to the above figure. A unit tax has been placed on the good. The producer pays what amount of the tax?

Refer to the above figure. A unit tax has been placed on the good. The producer pays what amount of the tax?

A. none of the tax B. P2 - P0 C. P1 - P0 D. P2 - P1

If the price of a good increases by 10% and the quantity demanded remains unchanged, then at that price, the good is

A. perfectly inelastic. B. elastic. C. perfectly elastic. D. inelastic.