The burden of a tax will fall primarily on sellers when the

a. demand for the product is highly inelastic and the supply is relatively elastic.

b. demand for the product is highly elastic and the supply is relatively inelastic.

c. tax is legally (statutorily) imposed on the seller of the product.

d. tax is legally (statutorily) imposed on the buyer of the product.

B

You might also like to view...

Under which of the following conditions will there be no substitution bias in the CPI?

A) Indifference curves are convex. B) Indifference curves are L-shaped. C) Indifference curves are linear. D) Indifference curves are downward sloping.

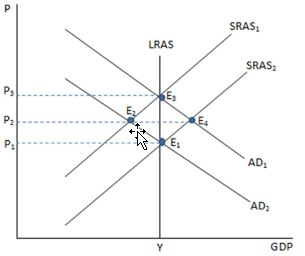

If the economy is represented in the graph shown and is currently at point E2, which action is the Fed most likely to undertake?

A. Expansionary monetary policy, because it will shift AD to the right.

B. Contractionary monetary policy, because it will shift AD to the left.

C. Expansionary monetary policy, because it will shift AD to the left.

D. Contractionary monetary policy, because it will shift AS to the right.

Which of the following is a true statement?

a. GDP per capita does not account for the difference in the cost of living among nations. b. The LDC classification is of the questionable accuracy. c. All of the answers are correct. d. GDP per capita is affected by exchange rate changes. e. GDP per capita ignores the degree of income distribution.

The effect of the tax on the quantity sold would have been larger if the tax had been levied on consumers.

Indicate whether the statement is true or false.