Use demand and supply analysis to explain why an expectation of Fed rate hikes would cause Treasury prices to fall

What will be an ideal response?

The expected return on bonds would decrease relative to other assets resulting in a decrease in the demand for bonds. The leftward shift of the bond demand curve results in a new lower equilibrium price for bonds.

You might also like to view...

Checkable deposits are

A. assets of commercial banks and savings institutions. B. debts of the federal government and government agencies. C. assets of the federal government and government agencies. D. debts of commercial banks and savings institutions.

The demand for mansions is elastic because a small percentage change in price results in a large change in quantity demanded

a. True b. False Indicate whether the statement is true or false

A consumer chooses an optimal consumption point where the

a. marginal rate of substitution exceeds the relative price ratio. b. slope of the indifference curve equals the slope of the budget constraint. c. ratio of the prices equals one. d. All of the above are correct.

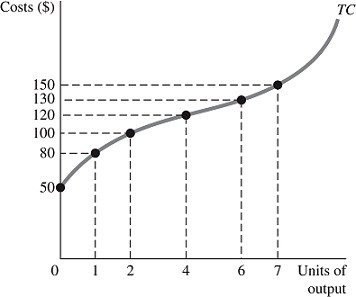

Refer to the short-run information provided in Figure 8.5 below to answer the question(s) that follow.  Figure 8.5 Refer to Figure 8.5. If six drones are produced, total variable costs are

Figure 8.5 Refer to Figure 8.5. If six drones are produced, total variable costs are

A. $10. B. $13.33. C. $70. D. $80.