Assume Fleet does not contribute the capital deficiency. How much cash is available to distribute to the partners?

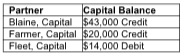

A partnership is liquidating. The partners share profits and losses equally. After liquidating the assets and paying the liabilities, the partners'; capital accounts are as follows:

A) $43,000

B) $49,000

C) $63,000

D) $77,000

B) $49,000

$43,000 + $20,000 - $14,000 = $49,000

You might also like to view...

Use this information to answer the following question. Gross payroll $16,000 Federal income taxes withheld $1,800 Social security and Medicare rate 7.65% Federal unemployment tax rate .8% State unemployment tax rate 5.4% Payroll Taxes and Benefits Expense would be recorded for

a. $1,224. b. $2,216. c. $4,016. d. $992.

What is an agent's duty to account?

What will be an ideal response?

A single integrated collection of data stored in one place that is used by employees throughout the organization is called a/an:

a. data collection b. database c. data center d. management data center e. information center

An order for 110 units of Product A has been placed. There are currently 60 units of Product A on hand. Each A requires 4 units of Part B. There are 20 units of B available. What are the net requirements for B?

A) 20 B) 120 C) 180 D) 240 E) 440