Suppose that during the last five years the rate of inflation was 3 percent each year and the money supply had grown 6 percent annually during the period. However, during the last nine months, the Fed has expanded bank reserves more rapidly and the money supply has been growing at a 12 percent annual rate. As a result, the expected inflation rate for the next period will be

a. higher than 3 percent under the rational expectations hypothesis.

b. 3 percent under the adaptive expectations hypothesis.

c. higher than 3 percent under both the adaptive and rational expectations hypotheses.

d. both a and b.

D

You might also like to view...

The basic idea behind moral hazard is that ________

A) some economic transactions impose an additional cost on society B) some economic transactions give rise to an additional benefit to society C) people tend to take more risks if they do not have to bear the costs of their behavior D) people do not reveal their true preference for goods that are non-excludable in consumption

________ is defined as national income + transfers - taxes

A) Disposable income B) Personal income C) GDP D) Gross private domestic investment

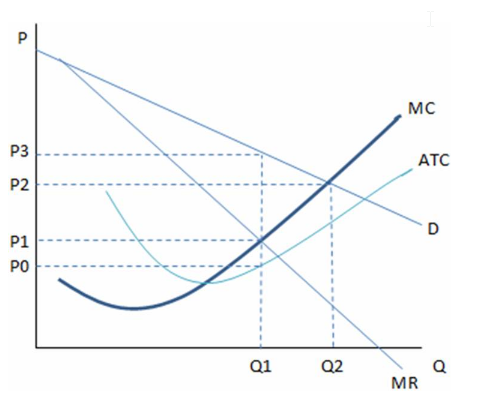

According to the graph shown, if Q2 units are being produced, this monopolist:

This graph shows the cost and revenue curves faced by a monopoly.

A. is earning negative economic profits.

B. is earning positive economic profits.

C. is earning zero economic profits.

D. may be earning zero accounting profits.

Bank holding companies developed:

A. so foreign banks could open branches in the U.S. B. so that unit banks could combine into larger banks. C. to circumvent the regulation by the Office of the Comptroller of the Currency. D. to get around the limitations on bank branching.