Suppose there are two types of bonds (one-year bonds and two-year bonds) and that the yield curve is initially upward sloping in period t. Note: For this question assume that: (1 ) expected inflation is zero; and (2 ) the relevant interest rate on the vertical axis of the IS-LM model is the one-year interest rate. Based on our understanding of the IS-LM model, of the yield curve and of financial

markets, we know with certainty that an announcement in period t of a partially unexpected future increase in taxes (to be implemented in period t + 1 ) will have which of the following effects?

A) stock prices will increase in period t

B) stock prices will fall in period t

C) the yield curve will become steeper in period t

D) none of the above

D

You might also like to view...

Due to a boom in the US, the average rate of return on investments is likely to rise causing the US dollar to

a. Appreciate b. Depreciate c. Not change in value d. None of the above

Assume the MPC is 0.65 . Assuming only the multiplier effect matters, a decrease in government purchases of $20 billion will shift the aggregate demand curve to the

a. left by about $30.77 billion. b. left by about $57.1 billion. c. right by about $57.1 billion. d. right by about $30.77 billion.

Bankers must always trade off

A. honesty and dishonesty. B. stocks and loans. C. prudence and profits. D. gold and cash. E. All of these responses are correct.

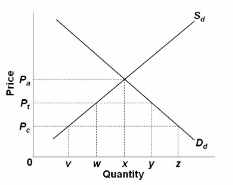

Refer to the diagram, where S d and D d are the domestic supply and demand for a product and P c is the world price of that product. With a per-unit tariff of P c P t , the total amount of tariff revenue collected on this product will be:

A. P a P t times wy.

B. P c P a times x.

C. P c P t times wy.

D. P c P t times z.