Two corporations (TruBlu and FlyByNight) issue perpetuities that both pay $1,000 per year, but the market price of the FlyByNight bonds are much lower

The difference in the bond prices may reflect the belief that the bonds issued by FlyByNight are ________ risky when compared to the TruBlu bonds. A) less

B) more

C) equally

D) none of the above

B

You might also like to view...

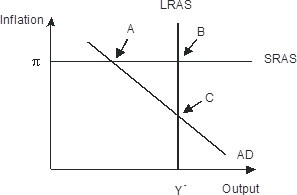

The economy pictured in the figure below has a(n) ________ gap with a short-run equilibrium combination of inflation and output indicated by point ________.

A. recessionary; B B. recessionary; C C. recessionary; A D. expansionary; A

According to the Taylor rule, which of the following will lead to a higher nominal federal funds rate?

A) an increase in inflation B) a positive output gap C) a positive inflation gap D) all of the above E) none of the above

See the information in Scenario 4.4. Suppose P = 10, Pc = 100, Pd = 2, A = 5, and I = 50. What is the cross-price elasticity of Rock and Roll Trivia programs and diskettes?

A) -1/90 B) 0 C) 1/90 D) 1 E) none of the above

The MC = MR approach to profit maximization means that a firm should produce until

a. marginal revenue equals zero b. additional profit equals zero c. marginal cost becomes negative d. marginal revenue equals price e. price equals average total cost