Suppose that the market for product X is characterized by a typical, downward-sloping, linear demand curve and a typical, upward-sloping, linear supply curve. If a $2 tax per unit results in a deadweight loss of $200, how large would be the deadweight loss from a $6 tax per unit?

The deadweight loss will be $1,800 because the deadweight loss rises by the square of the tax increase. Thus, if the tax triples, the deadweight loss increases nine-fold.

You might also like to view...

The breakdown of the Bretton Woods system occurred because

a. the world economy was basically unhealthy b. the collapse of world gold production undermined the operation of the system c. the gold value of the dollar exceeded the exchange value, causing an outflow of the gold d. the dollar was undervalued e. of the greed of the highly industrialized and wealthy countries of the world

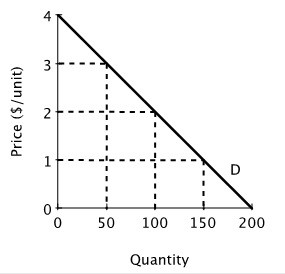

Suppose Acme and Mega produce and sell identical products and face zero marginal and average cost. Below is the market demand curve for their product.  Suppose Acme and Mega decide to collude and work together as a monopolist with each firm producing half the quantity demanded by the market at the monopoly price. If Mega cheats on the agreement by reducing its price to $1 while Acme continues to comply with the collusive agreement, then Mega will then sell ________ units and Acme will sell ________ units.

Suppose Acme and Mega decide to collude and work together as a monopolist with each firm producing half the quantity demanded by the market at the monopoly price. If Mega cheats on the agreement by reducing its price to $1 while Acme continues to comply with the collusive agreement, then Mega will then sell ________ units and Acme will sell ________ units.

A. 150; 50 B. 150; 0 C. 100; 0 D. 100; 50

Which of the following is NOT a transfer payment?

A. Social Security retirement payments B. Social Security disability payments C. spending on national defense D. Medicare

If cost-push inflation occurs and the government adopts a "hands-off" policy approach, then according to the simple extended AD-AS model, in the long run the economy will:

A. Get back to where it started from B. Get stuck with high unemployment C. Experience an inflationary spiral D. Have a higher price level