The major differences between financial regulation in the United States and abroad relate to bank regulation. Specifically, in the past, the U.S. was the only industrialized country to subject banks to restrictions on ________

A) branching

B) lending

C) assets they may hold

D) the size they could grow to

A

You might also like to view...

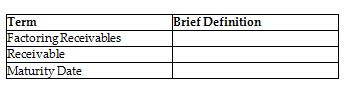

Provide a brief definition of each of the following terms.

Thermocore is a medium-sized company that produces wall paneling. Thermocore is a wholly-owned subsidiary of a holding company called Tempra-Sure, Inc Both Thermocore and Tempra-Sure, Inc are owned by the same individuals as principal shareholders

Thermocore has fallen on hard times due to a downturn in the construction industry in the primary market area the company serves. Sales of the company have declined and net losses have occurred for each of the last three years. The company is in dire need of cash but the owners of Tempra-Sure, Inc and Thermocore know that additional financing from a bank or other source is unlikely due to the company's weakened financial condition. The owners of Tempra-Sure, Inc and Thermocore believe that the downturn in construction will eventually reverse and that Thermocore will return to profitability when conditions improve. Based on these beliefs, the owners have proposed to the independent auditors a plan whereby the holding company (Tempra-Sure, Inc) would obtain a loan from a bank and then make an intercompany loan to Thermocore. Under this plan, the owners would sell their personal residences to Tempra-Sure, Inc. Lease agreements between Tempra-Sure, Inc and the owners would be drafted. These lease agreements would allow the owners to continue to occupy their homes. Title to the homes would pass to Tempra-Sure, Inc. Tempra-Sure, Inc would become involved in property management in addition to holding the stock of Thermocore. Tempra-Sure, Inc would have no additional properties other than the personal residences of the owners. The acquisition of additional properties by Tempra-Sure, Inc is unlikely. Required: Assume that you are the partner in the public accounting firm performing the audit of Tempra-Sure, Inc and Thermocore. Prepare your response to the owners of Tempra-Sure, Inc and Thermocore regarding the plan to obtain additional financing. Include references to the Conceptual Framework and underlying assumptions of accounting in your response.

Empire Moving Company reported the following amounts on its balance sheet as of December 31, 2016 and December 31, 2017

2017 2016 Cash and Receivables $105,000 $85,000 Merchandise Inventory 135,000 180,000 Property, Plant and Equipment, net 770,000 790,000 Total Assets $1,010,000 $1,055,000 Total Liabilities $435,000 $445,000 For the vertical analysis, what is the percentage of total liabilities for December 31, 2016? (Round your answer to two decimal places.) A) 100.00% B) 43.07% C) 19.10% D) 42.18%

To re-sort the Chart of Accounts, first display the Chart of Accounts window, then:

A. Click Account > Re-sort List B. Click File > Sort C. Click on the Company heading bar D. Right click > Sort by Name