A tariff on a particular good does which of the following?

A. It increases the net-of-tariff price received by foreign producers.

B. It increases the price of the good to domestic consumers.

C. It redistributes income away from domestic producers toward domestic consumers.

D. none of the above

B. It increases the price of the good to domestic consumers.

You might also like to view...

Potential GDP measures the capacity of the economy in terms of the actual goods and services to be produced

Indicate whether the statement is true or false

Any change in a firm's fixed costs will change its profit-maximizing level of output

a. True b. False Indicate whether the statement is true or false

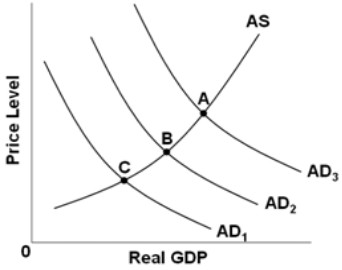

Use the following figure to answer the next question.  The economy is at equilibrium at point A. What fiscal policy would be most appropriate to control demand-pull inflation?

The economy is at equilibrium at point A. What fiscal policy would be most appropriate to control demand-pull inflation?

A. Shift aggregate demand by increasing government purchases. B. Shift aggregate supply by increasing taxes. C. Shift aggregate demand by decreasing taxes. D. Shift aggregate demand by increasing taxes.

If the opportunity cost of producing corn is lower for Ohio than for Iowa, then:

A. Ohio has the comparative advantage in corn production. B. Iowa has the comparative advantage in corn production. C. Iowa should export corn to Ohio. D. Iowa should specialize in corn production.