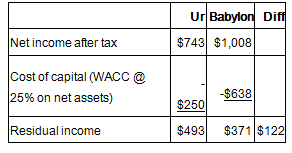

Mesopotamian Materials Inc. (MMI) has two decentralized divisions (Ur and Babylon) that have decision making responsibility over the amount of resources invested in their divisions. Recent financial extracts for both divisions are presented below:

*Net income is after tax but before interest

MMI's weighted average cost of capital (WACC) is 11.5%. The MMI measures division performance based on the book value of net assets. The producer price index 15 years ago was 100, 116 five years ago, and currently is 125.

Using historical costs, which is true?

A. Babylon is a profit center

B. At a WACC of 5%, Ur's residual income is lower than Babylon's by $122

C. At the planned WACC (11.5%), Ur's residual income is higher than Babylon's by $87

D. At a WACC of 25%, Ur's residual income is higher than Babylon's by $122

E. None of the above

D. At a WACC of 25%, Ur's residual income is higher than Babylon's by $122

You might also like to view...

On the work sheet, both the debit and the credit inventory amounts on the income summary line are extended to the Balance Sheet columns

Indicate whether the statement is true or false

In the context of political behavior in organizations, _____ encourages political activity.

A. clear goals B. definitive lines of authority C. abundant resources D. autocratic decision making

Proper retail balance occurs when consumer demands for one-stop shopping are satisfied

Indicate whether the statement is true or false

Cabinet members of cabinet-level federal departments are chosen directly by the president

Indicate whether the statement is true or false