An increase in the U.S. interest rate will most likely

A. lead to a decrease in the value of the U.S. dollar.

B. lead to an inflow of funds to the United States and an appreciation of the dollar.

C. provide a stimulus to U.S. export industries.

D. reduce the attractiveness of investment in the United States.

Answer: B

You might also like to view...

Which of the following increases as a result of an increase in real GDP?

i. autonomous expenditure ii. induced expenditure iii. potential GDP A) i only B) ii only C) iii only D) ii and iii E) i, ii, and iii

Which of the following observations would be valid if the Gini coefficient is equal to zero?

a. Perfect income inequality b. Greater degree of income inequality c. Lorenz curve overlaps the line of perfect income equality d. Unequal distribution of income

Which of the following influences the demand for money?

A. Only the money supply. B. Only the interest rate. C. Only the level of income. D. Both money supply and interest rate influence the demand for money.

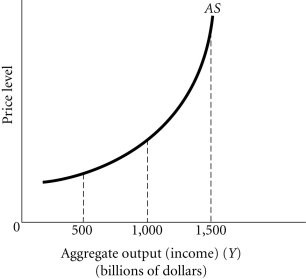

Refer to the information provided in Figure 26.1 below to answer the question(s) that follow. Figure 26.1Refer to Figure 26.1. At aggregate output levels above $1,500 billion, firms in this economy are most likely experiencing

Figure 26.1Refer to Figure 26.1. At aggregate output levels above $1,500 billion, firms in this economy are most likely experiencing

A. costs rising faster than output prices. B. costs lagging behind increases in output prices. C. costs falling as prices output increase. D. costs increasing as fast as output prices.