Briefly describe the Sarbanes-Oxley Act and explain why it was passed

What will be an ideal response?

The Sarbanes-Oxley Act of 2002 was enacted as a safeguard against scandals like the accounting scandals of the early 2000s, and was intended to increase confidence in the U.S. corporate governance system. The act requires that CEOs personally certify the accuracy of financial statements and that financial analysts and auditors disclose whether any conflicts of interest might exist that would limit their independence in evaluating a firm's financial condition.

You might also like to view...

The above figure shows the payoff matrix for two firms, A and B, choosing to produce a basic computer or an advanced computer

Now the payoff of the firm who produces a basic computer falls to 10 if the other firm chooses to produce an advanced computer. Then A) both firms will have dominant strategies. B) Nash equilibria will not change. C) joint profits will be maximized at the Nash equilibrium. D) Firm A and firm B will choose different actions.

Transfer payments include:

a. government spending on tanks and planes. b. government spending on national forests and parks. c. the salaries of senators and federal judges. d. welfare benefits and Social Security payments.

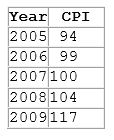

Using the information in the table shown, the rate of inflation from 2005 to 2006 was:

A. 5.32 %.

B. 5.05 %.

C. 5.00 %.

D. 6.00 %.

Which of the following would be most likely to encourage capital formation in a less-developed country?

a. the expectation of sustained high inflation b. the expectation that property rights will be highly secure in the years ahead c. the imposition of high tariffs and other restraints limiting imports d. higher personal and corporate tax rates