The average expected rate of return of a financial asset equals:

A. the rate that compensates for time preference plus the rate that compensates for risk.

B. the rate that compensates for time preference plus the rate of inflation.

C. beta plus the rate that compensates for risk.

D. the risk-free interest rate plus the rate of inflation.

A. the rate that compensates for time preference plus the rate that compensates for risk.

You might also like to view...

The determinants of investment include the

a. level of technology, the interest rate, expectations of future economic growth, and the level of income b. level of technology, the interest rate, expectations of future economic growth, and the capacity utilization rate c. level of technology, the interest rate, the capacity utilization rate, and the level of income d. level of technology, the capacity utilization rate, expectations of future economic growth, and the level of income e. capacity utilization rate, expectations of future economic growth, the interest rate, and the level of income

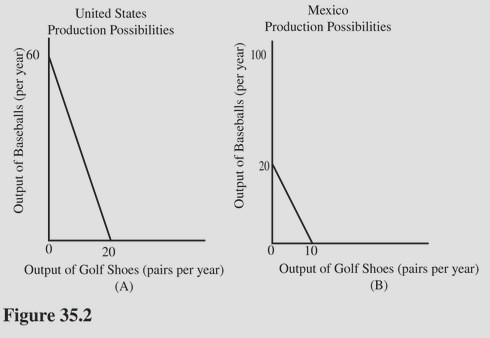

The production possibilities curves illustrated in Figure 35.2 reveal that

The production possibilities curves illustrated in Figure 35.2 reveal that

A. Mexico has no comparative advantage. B. Mexico has a comparative advantage in baseballs. C. The United States has an absolute advantage in both goods. D. The United States has no comparative advantage.

If a pure monopolist is producing more output than the MR = MC output:

A. the firm may, or may not, be maximizing profits. B. it will be in the interest of the firm, but not necessarily of society, to reduce output. C. it will be in the interest of the firm and society to increase output. D. it will be in the interest of the firm and society to reduce output.

The total burden of a tax is $10,000 and the tax revenue from this tax is $8,000. The excess burden of this tax is

A. $2,000. B. $8,000. C. $10,000. D. $18,000.