A few years ago, you bought a bond with no expiration and a fixed annual interest payment of $1,000 at a price of $10,000. If the interest rate in the economy is now 12.5% a year and you want to sell the bond, the maximum price that you can get for it is

A. $7,500.

B. $12,500.

C. $9,750.

D. $8,000.

Answer: D

You might also like to view...

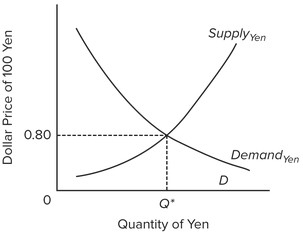

Use the following graph to answer the next question. Assume that Japan and the United States are engaged in a system of flexible exchange rates. An increase in the supply of yen will result in a(n) ________.

Assume that Japan and the United States are engaged in a system of flexible exchange rates. An increase in the supply of yen will result in a(n) ________.

A. increase in the dollar price of yen B. appreciation of the U.S. dollar C. depreciation of the U.S. dollar D. appreciation of the yen

Moral hazard refers to the actions people take after they have entered into a transaction that make the other party to the transaction worse off

Indicate whether the statement is true or false

What is one result of the Medicare subsidy?

A) The health care industry is more efficient than it otherwise would be. B) Patients may elect to have some treatments that are of low value to them but that are costly to provide. C) The elderly population in the United States receives a lower quality of medical care than what is provided for the elderly population in other countries. D) The number of physicians in the United States has declined.

The return to any factor of production that is in ________ is pure rent.

A. fixed supply B. variable demand C. fixed demand D. variable supply