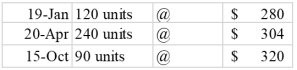

Max Company's first year in operation was Year 1. The following inventory purchase information comes from Max's accounting records for the year:  In December Year 1, Max sold 350 units for $480 each. Operating expenses for the year were $30,000, and the tax rate was 30%. Required: a) Calculate the cost of goods sold using LIFO.b) Calculate the cost of goods sold using FIFO. c) What amount of income tax would Max have to pay if it uses LIFO? d) What amount of income tax would Max have to pay if it uses FIFO? e) Assuming that the results for Year 2 are representative of what Max can generally expect, would you recommend that the company use LIFO or FIFO?

In December Year 1, Max sold 350 units for $480 each. Operating expenses for the year were $30,000, and the tax rate was 30%. Required: a) Calculate the cost of goods sold using LIFO.b) Calculate the cost of goods sold using FIFO. c) What amount of income tax would Max have to pay if it uses LIFO? d) What amount of income tax would Max have to pay if it uses FIFO? e) Assuming that the results for Year 2 are representative of what Max can generally expect, would you recommend that the company use LIFO or FIFO?

Explain.

What will be an ideal response?

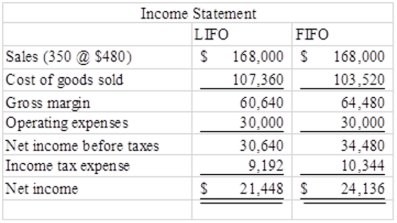

a) $107,360

b) $103,520

c) $9,192

d) $10,344

e) Based on this information, Max would be better off to use LIFO because of the lower amount of income taxes it would pay.

a) For LIFO, cost of goods sold = (90 × $320) + (240 × $304) + (20 × $280) = $107,360

b) For FIFO, cost of goods sold = (120 × $280) + (230 × $304) = $103,520

c) and d)

You might also like to view...

Ms. Jones believes that she became Vice President at her company by luck; she rarely takes responsibility for her actions and she often blames others when things don’t go well for her. She would be described as having ______.

a. grit b. hope c. an internal locus of control d. an external locus of control

According to research on service industry companies, which of the following types of organizations rated highest in outcome orientation?

A. US Postal Service B. all service industry companies scored high C. transportation companies D. accounting firms

Which of the following is not a possible cause of post-earnings-announcement drift?

a. Financial analysts over-react to fundamental signals stemming from securities. b. Shareholders do not distinguish well between the cash flow portions and the accrual portions of earnings. c. Financial analysts’ forecast errors lead to incomplete security price adjustments. d. Transaction costs are too high relative to the potential gain that can be earned from the mispricing of the securities.

Table 3-3

Marlett Company Financial Information December 2009 December 2010 Net Income $2,000 $4,000 Accounts receivable 750 1,250 Accumulated depreciation 1,000 1,400 Common stock 4,500 5500 Paid-in capital 7,500 8500 Retained earnings 1,500 3,500 Accounts payable 750 950 Based on the information in , prepare a statement of cash flows for 2010. Assume that there were no changes in any other asset or liability accounts, and that the ending cash balance for 2009 was $100.