Keogh plans and IRAs are

A) individual pension plans.

B) government pension plans.

C) corporate pension plans.

D) public pension plans.

A

You might also like to view...

When determining problem significance, urgency ________.

A. refers to potential for negative outcomes B. relates to impact C. relates to time D. All of the above.

One of the challenges of project scheduling is how to prevent the ________ of resources as a result of task slack times

A) purchase B) use C) idleness D) usefulness

Hannah, a single taxpayer, sold her primary residence on January 1, 2018. Her total realized gain is $210,000. The house was acquired on January 1, 2008, and rented to tenants until December 31, 2014. Hannah moved in on January 1, 2015, and used the house as her principal residence until the sale. During the rental period, $30,000 of depreciation was deducted. Due to the sale of the house in 2018, Hannah will recognize a gain of

A. $30,000. B. $147,000. C. $156,000. D. $138,000.

Answer the following statements true (T) or false (F)

1. Variable costing treats fixed overhead cost as a period cost.

2. The biggest problems with producing too much are lost sales and customer dissatisfaction.

3. Many companies link manager bonuses to income computed under absorption costing because this is how income is reported to shareholders.

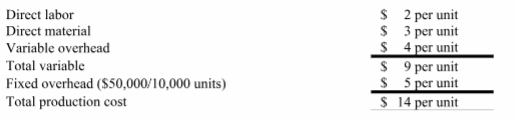

4. Under absorption costing, a company had the following unit costs when 10,000 units were produced:

The total product cost per unit under absorption costing if 25,000 units had been produced would be $11.

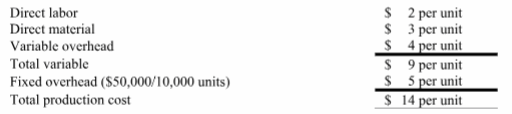

5. Assume a company had the following production costs:

Under absorption costing, the total product cost per unit when 4,000 units are produced would be $22.50.