Describe why benefit plans need to be communicated to employees.

What will be an ideal response?

Most employees don’t understand the true cost and value of the benefits that organizations provide and, as a result, don’t perceive the value that they get from having the organization provide their benefits. There are many indications that employees who are satisfied with their benefits are more satisfied with their jobs and their companies. Providing employees with knowledge concerning their benefit package will help to create and maintain trust in the organization as well as improve job satisfaction on the part of those employees.

You might also like to view...

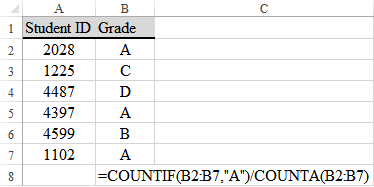

What would be the outcome of cell B8?

a) 3

b) 6

c) 33.33%

d) 50.00%

e) 66.67%

Service markets are shaped by all of the following except ____________

a. government policies b. social changes c. global economic change d. business trends e. advances in information technology

Roger wants to buy a new car, so he borrows money from the bank. Several months later, he

sells his car to Lisa, who agrees to pay the bank loan. A) Roger is an intended third-party beneficiary. B) Lisa is an intended third-party beneficiary. C) Lisa is an incidental third-party beneficiary. D) The bank is an intended third-party beneficiary. E) The bank is an incidental third-party beneficiary.

Mr. and Mrs. Pitt filed a joint tax return last year. The couple divorced this year. The IRS audited their last year's return and determined that the Pitts had underpaid their tax by $38,200. Which of the following statements is true?

A. Because the couple is divorced, the IRS must assess Mr. Pitt with a $19,100 deficiency and Mrs. Pitt with a $19,100 deficiency. B. The IRS must assess whichever spouse actually prepared the return for the entire deficiency. C. The IRS can assess either Mr. Pitt or Mrs. Pitt for the entire deficiency. D. Because the couple is divorced, the IRS must apportion the deficiency between Mr. and Mrs. Pitt based on their relative contribution to taxable income.