In the simple deposit expansion model, a decline in checkable deposits of $1,000 when the required reserve ratio is equal to 20 percent implies that the Fed

A) sold $200 in government bonds.

B) sold $500 in government bonds.

C) purchased $200 in government bonds.

D) purchased $500 in government bonds.

A

You might also like to view...

People who attend college for four years in order to equip themselves to earn higher incomes in later life are

A) discounting the future at a higher rate than do people who don't attend college. B) giving up future satisfaction for the sake of current satisfaction. C) ignoring the fact that future income has less value than current income. D) investing in human capital. E) revealing a high rate of time preference.

When the Fed conducts expansionary monetary policy, lower short-term interest rates will tend to stimulate the economy. How will the change in the velocity of money affect this result?

a. Velocity will decline, enhancing the stimulus effect. b. Velocity will increase, somewhat dampening the stimulus effect. c. Velocity will increase, enhancing the stimulus effect. d. Velocity will decline, somewhat dampening the stimulus effect.

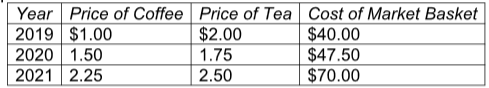

According to the following table, what is the price index for 2021 if 2019 is the base year?

a. 1.47

b. 1.75

c. 147

d. 175

The marginal benefit in the table is:Control variableTotal BenefitsTotal CostsNet BenefitsMarginal BenefitMarginal CostMarginal Net BenefitQB(Q)C(Q)N(Q)MB(Q)MC(Q)MNB(Q)0000---190010080090010080021,700300C80020060032,4006001,800700E4004A1,0002,00060040020053,5001,5002,000500500F63,9002,1001,800D600-20074,2002,8001,400300700-40084,400B800200800-60094,5004,5000100900-800104,5005,500-1,00001,000-1,000

A. increasing at a constant rate. B. increasing at a decreasing rate. C. decreasing at a constant rate. D. decreasing at an increasing rate.