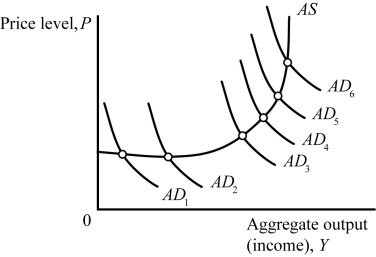

Refer to the information provided in Figure 27.2 below to answer the question(s) that follow. Figure 27.2Refer to Figure 27.2. In response to a decrease in net taxes, the Fed would increase the interest rate by the least amount when the aggregate demand curve shifts from

Figure 27.2Refer to Figure 27.2. In response to a decrease in net taxes, the Fed would increase the interest rate by the least amount when the aggregate demand curve shifts from

A. AD1 to AD2.

B. AD3 to AD4.

C. AD5 to AD6.

D. AD1 to AD6.

Answer: A

You might also like to view...

All of the following statements would make a reasonable hypothesis to test except

A) Long-run economic growth leads to higher real GDP per capita. B) An inflation rate below 3% is good for an economy. C) Increasing tax rates eventually lead to a decrease in work effort. D) Decreases in the unemployment rate lead to increases in the rate of inflation.

Assume that two individuals, A and B, are willing to trade products X and Y. Before a possible trade, A has the following marginal rates of substitution of X for Y (or of Y for X): MRSXYA = 0.80 (or equivalently, MRSYXA = 1.25)

Also, before a possible trade, B has these marginal rates of substitution of X for Y (or of Y for X): MRSXYB = 1.50 (or equivalently, MRSYXB = 0.67). Determine if trade can take place that would benefit either or both. If trade can benefit either or both, determine who will trade for what.

If the interest rate is 8 percent, then the present discounted value of $100 to be received two years from now is closest to

A. $116.00. B. $86.00. C. $96.00. D. $128.00.

Explain why a corporation may find it advantageous to undertake greater investment when the value of its stock shares increase.

What will be an ideal response?