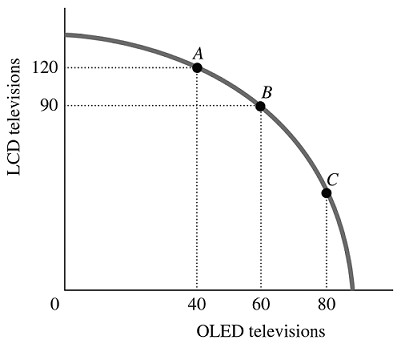

Refer to the information provided in Figure 2.5 below to answer the question(s) that follow. Figure 2.5Refer to Figure 2.5. The marginal rate of transformation in moving from Point A to Point B is

Figure 2.5Refer to Figure 2.5. The marginal rate of transformation in moving from Point A to Point B is

A. -2/3.

B. -1.5.

C. -3.

D. -30.

Answer: B

You might also like to view...

Using the Gordon growth model, if D1 is $.50, ke is 7%, and g is 5%, then the present value of the stock is

A) $2.50. B) $25. C) $50. D) $46.73.

A country has a (an) __________ in the production of a good it produces at lower opportunity cost than another country

A) absolute advantage B) specialization disadvantage C) tariff-efficient advantage D) infant-industry advantage E) none of the above

The short-run price elasticity of demand for airline travel is 0.05, while the long-run elasticity is 2.36. This means that a significant increase in airline ticket prices will cause airline companies to:

A. collect less revenue from short-notice travelers. B. collect more revenue from travelers who book well in advance. C. lose money on short-notice travelers. D. collect less revenue from travelers who book well in advance.

Table 1.2 shows the hypothetical trade-off between different combinations of Stealth bombers and B-1 bombers that might be produced in a year with the limited U.S. capacity, ceteris paribus.Table 1.2Production Possibilities for BombersCombinationNumber of B-1 BombersOpportunity cost(Foregone Stealth)Number of Stealth BombersOpportunity cost (Foregone B-1)A20NA195 B35 180 C45 150 D50 100NAOn the basis of your calculations in Table 1.2, what is gained by producing at point B rather than point C?

A. 10 B-1 bombers. B. 45 B-1 bombers. C. 30 Stealth bombers. D. 180 Stealth bombers.