Suppose the government wants to discourage excessive consumption of alcohol. It therefore imposes a per-unit tax on alcohol that increases as more alcohol is bought by a consumer at a store. What happens to a consumer's budget at a liquor store (with liters of alcohol on the horizontal axis and a composite good on the vertical) --- assuming the consumer takes only one trip to the store.

A. The vertical intercept decreases and the slope becomes shallower as more alcohol is bought.

B. The vertical intercept remains constant but the slope becomes shallower as more alcohol is bought.

C. The vertical intercept decreases and the slope becomes steeper as more alcohol is bought.

D. The vertical intercept remains constant but the slope becomes steeper as more alcohol is bought.

E. None of the above.

Answer: D

You might also like to view...

Why is it more difficult for a firm to calculate the marginal revenue product of a player in the industry of professional sports versus that of a worker in a competitive manufacturing industry?

What will be an ideal response?

The Fed and Treasury took action to restore the flow of funds from savers to borrowers in order to encourage all of the following EXCEPT:

A) increase the return to savers B) enable households to purchase durable goods C) increase the likelihood of purchases of houses D) allow firms to finance purchases of structures and equipment

You could borrow $2,000 today from Bank A and repay the loan, with interest, by paying Bank A $2,154 one year from today. Or, you could borrow X dollars today from Bank B and repay the loan, with interest, by paying Bank B $2,477.10 one year from today. In order for the same interest rate to apply to the two loans, X =

a. $2,300.00. b. $2,450.00. c. $2,500.00. d. $2,525.50.

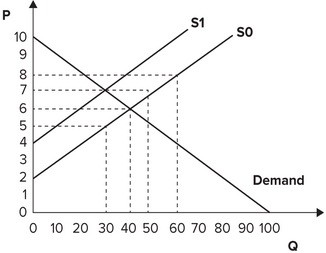

Refer to the graph shown. Assume that the market is initially in equilibrium at a price of $6 and a quantity of 40 units. If the government imposes a $2 per-unit tax on this product, the deadweight loss from the tax will be:

A. 80. B. 70. C. 60. D. 10.