Suppose you purchase a $1,000 bond that bears an interest rate of 10 percent. What will happen if the interest rate goes to 20 percent?

a. The market price of the bond will increase to $2000.

b. The market price of the bond will drop to $500.

c. The return on the bond will double.

d. The return on the bond will halve.

b

You might also like to view...

If the price of a slice of pizza rises from $2.50 to $3, and quantity demanded falls from 10,000 slices to 7,400 slices, calculate the arc price elasticity

A) -1.92 B) -1.64 C) -4 D) -2

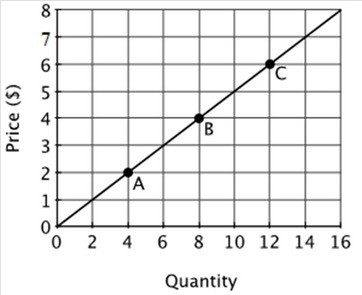

Refer to the accompanying figure. What is the slope of the supply curve?

A. 4 B. 2 C. 1 D. 1/2

Economist Douglass North's definition of institutions:

A. includes laws enforced by the government as well as cultural norms. B. is the humanly devised constraints that shape human interactions. C. is the rules of the game in a society. D. All of these statements are true.

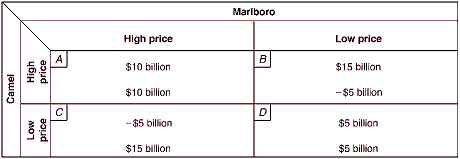

Exhibit 9-7 Two-Firm Payoff Matrix

?

A. Camel charging the high price and Marlboro charging the high price. B. Camel charging the low price and Marlboro charging the low price. C. Camel charging the low price and Marlboro charging the high price. D. Camel charging the high price and Marlboro charging the low price.