What is the dividends received deduction (DRD) in each of the following independent cases? a. Taxable income before DRD is $50,000. Dividend from a 30%-owned domestic corporation is $5,000. b. Taxable income before DRD is $300,000. Dividend from a 10%-owned domestic corporation is $75,000. c. Taxable income before DRD is $80,000. Dividend from a 60%-owned domestic corporation is $90,000.

What will be an ideal response?

a. The DRD is 65% of the dividend, or $3,250.

b. The DRD is 50% of the dividend, or $37,500.

c. Although the DRD would normally be 65% of $90,000, the DRD is limited to 65% of taxable income, or $52,000.

You might also like to view...

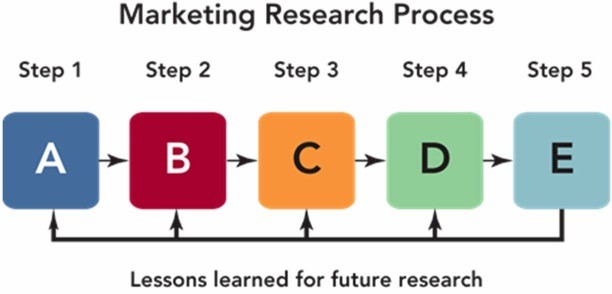

Figure 7-1According to Figure 7-1 above, setting research objectives occurs during which step of the five-step marketing research approach?

Figure 7-1According to Figure 7-1 above, setting research objectives occurs during which step of the five-step marketing research approach?

A. A B. B C. C D. D E. E

Which two types of power can be obtained regardless of the official position within an organization?

What will be an ideal response?

One of the best ways to control a petty cash fund is through an imprest system

Indicate whether the statement is true or false

Voluntary export restraints are imposed by the importing nation to avoid violating WTO rules.

Answer the following statement true (T) or false (F)