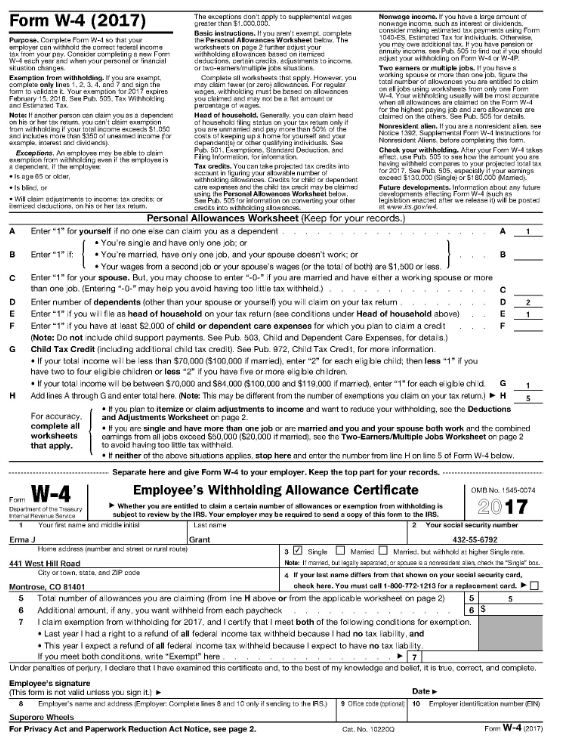

Complete the W-4 for employment at Superore Wheels

Erma Jane Grant

441 West Hill Road

Montrose, Colorado 81401

SSN: 432-55-6792

Single, head of household

Two dependents

Eligible for the Child tax credit with one child and an annual salary of $36,000

$1,500 in child care expenses

Not claiming additional amounts to be withheld

Not claiming exemption from withholding

What will be an ideal response?

You might also like to view...

Capra’s third criterion is ______.

A. process B. the living system’s cognitive activity C. allowing a living system to perceive, sort, and select specific elements from the external environment D. all of these

Use the information in Scenario 9.7. What is the cost of holding the safety stock necessary to maintain the 98% service level?

A) less than or equal to $30 B) greater than $30 but less than $40 C) greater than $40 but less than $50 D) greater than $50

Sean is a vice-president for 20th Century Fox, a movie production company. He has the responsibility for managing the firm's marketing channels and its relationships with its marketing intermediaries. As a manager of its marketing intermediaries, part of Sean's role is to

A. link movie wholesalers to other wholesalers. B. link film producers to other middlemen. C. always oversee the sale of movies to retailers. D. maintain quality of the movie product. E. engage in short-term commitments to the least expensive channel member.

In most situations involving sales, rights and liabilities are determined by who has the title to the goods.?

Indicate whether the statement is true or false