What would in happen in a given market if transaction costs for the product traded were reduced? Generally, what is the impact of transaction costs on market operations?

What will be an ideal response?

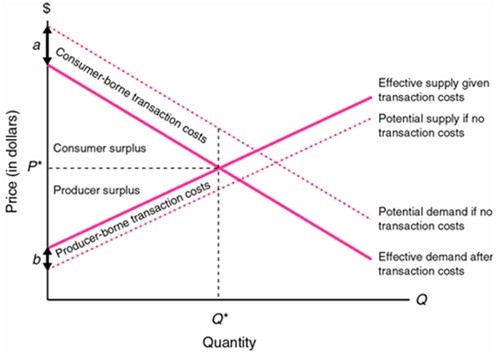

The dashed supply and demand curves illustrate the market when transaction costs are reduced to zero. Consumer-borne transaction costs increase the costs to consumers from participating in the market, reducing the quantity of goods exchanged, the consumer surplus, and the producer surplus. Producer-borne transaction costs increase the costs to producers from participating in the market, reducing the quantity of goods exchanged, the consumer surplus, and the producer surplus.

You might also like to view...

Holding money as a medium of exchange to make payments is

A) the capital demand for money. B) the transactions demand for money. C) the precautionary demand for money. D) the asset demand for money.

Which of the following is the best example of an intermediate good?

a. a tire purchased by an auto company b. a new house purchased by a newly married couple c. grain sold to foreign farmers d. All of the above are intermediate goods.

When a positive externality is present in a market, total surplus is:

A. higher when buyers only consider private benefits. B. lower when buyers receive a Pigouvian subsidy for the externality. C. higher when buyers receive a Pigouvian subsidy for the externality. D. Any of these statements could be true.

A Nash equilibrium with a noncredible threat as a component is:

A. not a perfect equilibrium. B. a somewhat perfect equilibrium. C. a sequential equilibrium. D. a perfect equilibrium.