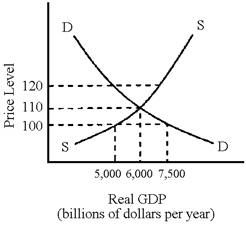

Figure 10-1

If the price level in Figure 10-1 were 120,

a.

there would be excess goods on the market.

b.

firms would have to raise their prices.

c.

inventories would be disappearing.

d.

aggregate quantity demanded would exceed aggregate quantity supplied.

a

You might also like to view...

With the federal funds rate near zero and the economy still struggling, In response to already low interest rates doing little to stimulate the economy, the Fed began buying 10-year Treasury notes and certain mortgage-backed securities to keep

interest rates low. This policy is known as A) quantitative easing. B) securities-bubble deflating. C) contractionary monetary policy. D) inflation targeting.

One result of asymmetric information about people's ability to repay a loan is that:

A. loans will only be made to people who don't pay them back. B. a bank could make many loans to people who don't pay them back. C. lenders are better off than with perfect information. D. banks will not make loans.

In a competitive market where the elasticity of the market demand curve is -1.5, the number of firms is 20, and an individual firm faces a residual demand curve with an elasticity of -68. What is the elasticity of the supply curve?

A) 0.5 B) 1.2 C) 2 D) Cannot be determined.

If Microsoft is earning a rate of return greater than the return necessary for the business to continue operations in the long run, then

A. total costs exceed total revenue. B. the normal rate of return is zero. C. the firm is earning an economic profit. D. total costs exceed a normal rate of return.