Suppose gross domestic product (GDP) is $5 billion, government transfer payments are $1.5 billion, indirect business taxes and transfers are $0.25 billion, and depreciation is $0.5 billion. Then national income equals

A. $3.25 billion.

B. $2.75 billion.

C. $5 billion.

D. $4.25 billion.

Answer: D

You might also like to view...

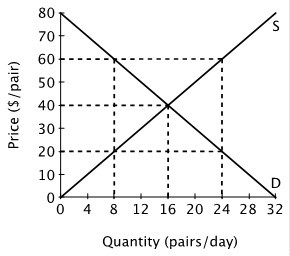

The figure below shows the supply and demand curves for jeans in Smallville.  At the price of $60 per pair, sellers offer _____ pairs of jeans per day, and buyers wish to purchase ________ pairs of jeans a day.

At the price of $60 per pair, sellers offer _____ pairs of jeans per day, and buyers wish to purchase ________ pairs of jeans a day.

A. 8; 24 B. 16; 16 C. 24; 8 D. 60; 20

One reason governments impose taxes is to ________

A) reduce the number of transactions in an economy B) redistribute funds via transfer payments C) increase competition among producers D) increase the volume of exports

A perfectly competitive firm's demand curve is

A) upward sloping. B) downward sloping. C) a vertical line. D) a horizontal line.

Suppose that the demand for my new book, Spatulas From Around the World, is such that the demand curve lies everywhere below the average variable cost of producing it. To maximize profits or minimize losses, I should

a. raise price b. lower price to increase demand c. shut down the presses printing my book d. lower price until demand is inelastic e. charge the highest price I can