A student buys only two goods pizza and books. The price of pizza is $5 and the price of books is $10. At the student's present level of consumption, her marginal utility of pizza is 4 and her marginal utility of books is 2. Currently, the student is spending all her income.A. Is this student currently in consumer equilibrium (maximizing utility)? Explain using a graph.B. What would this student have to do in order to increase her utility? Use the diagram from part (a) to explain your answer.

What will be an ideal response?

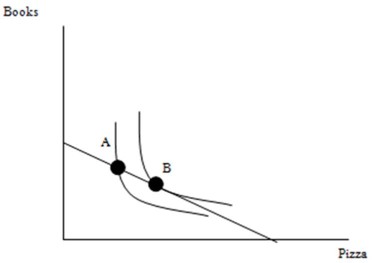

A. At first the student is not maximizing because the slope of the indifference curve is stepper than the slope of the budget line (point A).

B. In order to increase utility she needs to consume more pizza and less books up to where the slope of the indifference curve is the same as the slope of the budget line. This happens at point B.

You might also like to view...

Other things constant, if the Fed decreased the discount rate,

a. the earnings of the Fed would increase. b. the incentive of commercial banks to borrow from the Fed would be reduced. c. the prime interest rate would automatically decline. d. commercial banks probably would reduce their excess reserves and be more willing to extend additional loans.

Some of our farm fields are being left unused. Does this have any implications for the economy's PPF diagram (with agricultural products on one axis and all other products on the other axis)?

A) No implications, because the PPF deals only with resources in use. B) The PPF cannot be drawn if some resources are idle. C) With unemployed resources, we are at a point below the PPF. D) The PPF would be upward sloping.

M2 is comprised of

A) small-denomination time deposits + savings deposits + money market accounts. B) small-denomination time deposits + credit cards + money market accounts + gold deposits. C) M1 + small-denomination time deposits + savings deposits + retail money market mutual funds. D) M1 + small denomination time deposits + credit cards + money market accounts.

To reduce the money supply, the Fed can ______.

a. buy bonds b. raise reserve requirements c. lower the discount rate d. decease the interest rate paid on reserves