How is the utility of a gamble to a risk averse person different from that to a risk neutral person?

For a risk averse person the expected utility derived from the wealth invested in a gamble is always lower than the actual utility derived from the wealth. He would be ready to pay someone to take the gamble away from him. On the other hand, a risk neutral person is indifferent between taking or avoiding a gamble with a zero expected return.

You might also like to view...

The budget line can shift or rotate

A) only when income changes. B) only when prices change. C) when either income or prices change. D) None of the above, because changes in income and prices do not shift or rotate the budget line.

Gross domestic product (GDP) includes:

a. used goods sold in the current time period. b. only final goods and services. c. foreign goods as well as domestically produced goods. d. intermediate as well as final goods.

Which of the following is a source of market risk?

a. Holding stocks in many companies carries the risk of a reduced average return. b. Real GDP varies over time and sales and profits move with real GDP. c. When a paper producer has declining sales, it is likely that so will other paper producers. d. If stockholders become aggravated with the way a CEO runs a company, the price of that company's stock might fall in the stock market.

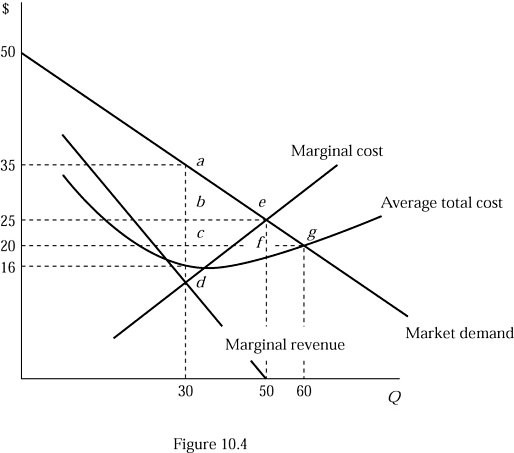

Suppose that Figure 10.4 shows an industry's market demand, its marginal revenue, and the production costs of a representative firm. If the industry was perfectly competitive, it would produce a quantity of:

Suppose that Figure 10.4 shows an industry's market demand, its marginal revenue, and the production costs of a representative firm. If the industry was perfectly competitive, it would produce a quantity of:

A. 30 units. B. 50 units. C. 60 units. D. There is not sufficient information.